Private equity firms once used financial leverage as their main tool for boosting the internal rate of return (IRR) on their portfolio companies. Now, as value creation has moved beyond financial engineering, operational improvement is the most frequently used lever.

In particular, many PE firms are enhancing the value of their portfolio companies through add-on acquisitions. A study of private equity by The Boston Consulting Group found that M&A is the most common approach to improving the operational value of portfolio companies, used by 91% of the firms surveyed. (See Private Equity: Engaging for Growth, BCG report, January 2012.)

Buy-and-Build Deals

Buy-and-build deals (in which a PE firm buys a company and then builds on that “platform” through add-on acquisitions) can both accelerate revenue growth and drive margin expansion by realizing synergies. Furthermore, buy-and-build strategies can create market expectations of continued growth and margin improvements in portfolio companies, which can translate into higher exit valuations.

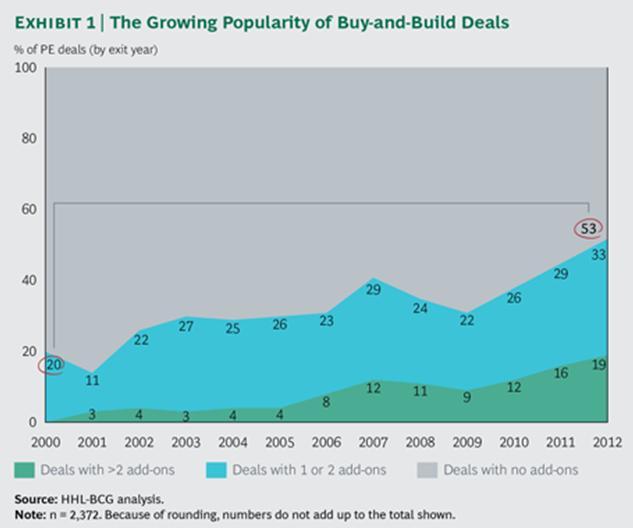

To gain a better understanding of the increasing importance of buy-and-build deals as a means of operational improvement, BCG collaborated with HHL Leipzig Graduate School of Management to analyze 2,372 deals exited from 1998 through 2012. The results reveal that the share of PE deals that include add-on acquisitions climbed from 20% of all deals in 2000 to 53% in 2012 (See Image 1). The average number of add-on acquisitions per deal grew from 1.3 in 2000 to 2.7 in 2012.

There’s one simple reason for the surge in buy-and-build deals: they outperform standalone PE deals, generating an average IRR of 31.6% from entry to exit, compared with an IRR of 23.1% for standalone deals.

The study also sheds light on how buy-and-build deals create value. For instance, small portfolio companies often have the most to gain from add-on acquisitions, and using acquisitions to build depth, rather than breadth, generates higher returns. Taken together, the findings of the analysis suggest the capabilities that are crucial for PE firms and platform companies and reveal the circumstances in which buy-and-build deals lead to superior performance.

![5 Reasons You Should Travel Alone Airplane [image source: chau nguyen/ http://thedevilhatessweatpants.blogspot.com.au ], crowd ink, crowdink, crowdink.com, crowdink.com.au](https://crowdink.com/wp-content/uploads/2016/08/Chau-airplane-218x150.jpg)

![5 Reasons You Should Travel Alone Airplane [image source: chau nguyen/ http://thedevilhatessweatpants.blogspot.com.au ], crowd ink, crowdink, crowdink.com, crowdink.com.au](https://crowdink.com/wp-content/uploads/2016/08/Chau-airplane-100x70.jpg)